Some traders have heard of new short forms for the first time as they begin trading. New traders are perplexed by phrases like TBQ and TSQ when experts utilize them, thinking they don't know what TBQ or TSQ stand for.

So if you are new to trading, don't worry! Today, on this blog, I am going to provide you with information about what TBQ and TSQ stand for.

Let's look at the definitions of TBQ and TSQ, as well as an example involving these two words.

Also read: What is Trigger Price?

What is TBQ?

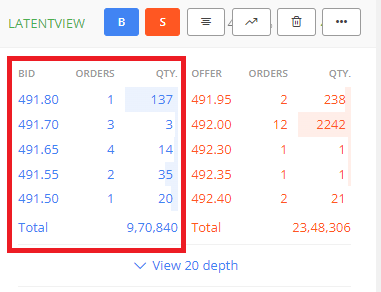

TBQ is a term used in the stock market to refer to the Total Buy Quantity or Total Bid Quantity. It's the total of all open buy orders for a stock on the exchange.

To enhance the data's value on your trading platform, you can view it in real-time on graphs or tables. This is apparent when you go to the market depth after clicking on the market depth button.

The example of TBQ, in this case, is the total number of shares that traders have available to purchase.

For example, if there are 100 shares from 25 traders to buy, the TBQ is 100.

Most broking platforms show 5 top buyers. However, you can even see more by a click on view 20 depth option in some of the platforms like Zerodha. It is entirely dependent on the brokerage firm for the kinds of features it has to offer.

What is TSQ?

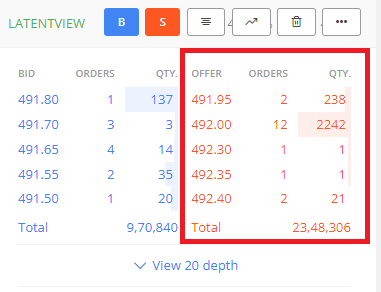

In the stock market, the full form of TSQ is Total Sell Quantity. It is also referred to as TOQ, which stands for Total Offer Quantity. It's the total of all current sell orders on the exchange for a stock, it is just the opposite of TBQ.

You'll notice something similar in your trading platform if you click on market depth after selecting a pair. Most broking apps or platforms show only 5 top sellers. However, in some of the broking platforms, you may view up to 20 depths by clicking on the view 20 depth option.

You can see the numbers of shares and traders interested in selling them. The example of TSQ, in this case, is the total number of shares that are on sale.

For example, if there are 100 shares on sale from 25 traders, the TSQ is 100.

What is TTQ?

TTQ stands for Total Traded Quantity. It's the sum of TBQ and TSQ. In other words, the entire equity exchanged in a particular share during a day.

For example, if the TBQ is 100 shares and the TSQ is also 100 shares, then it adds up to TTQ being 200 shares.

Thus, TTQ = TBQ + TSQ. It is another measure of the total volume or quantity traded in a particular stock.

The Total Traded Quantity is also sometimes called the Turnover, which gives you an idea of how many stocks are passing through the market.

The TTQ is used to measure the liquidity for a particular share or exchange and is used as a parameter to determine the volatility of stocks or higher markets.

How do TBQ and TSQ change?

The number of TBQ and TSQ changes when the stock's volatility fluctuates. The sum of supply and demand for the stock is the total number of TBQ and TSQ. The number on the TBQ side will go up if demand rises and supply is low, whereas the amount on the TSQ side will decline.

For example, if the trading in a particular stock increases, then there may be a demand for a large quantity of that stock. This leads to the price of the stock going up and the sum of TBQ and TSQ is greater than what it was before.

Similarly, if the trading in a particular stock decreases, then the demand decreases along with it. This leads to the price of the stock going down and the sum of TBQ and TSQ is less than what it was before.

However, prices may not immediately change in response to the demand and supply, because it is determined by the exchange's algorithm. The majority of individuals believe that price goes up when demand and supply increase. It is somewhat true in most situations, but it is not always the case.

What are the significance of TBQ and TSQ?

Following are some major significance of TBQ and TSQ.

The most common two methods to calculate prior loss are via the TBQ and TSQ. They offer insight into where to take an entry in the stock.

They are also beneficial in risk management since you may exit any trade if supply grows or demand begins to plummet.

The average of TBQ and TSQ is published every day on exchanges, which will help you in long-term investing.

The label that a stock is a liquid stock or an illiquid stock is also aided by TBQ and TSQ.

They also assist in determining stock that is suitable for intraday trading.

What is ATP in stock market?

An arbitrage trading program (ATP) is a computer program that seeks to take advantage of financial market arbitrage possibilities. When financial market mispricing opportunities arise, investors can make money by taking positions on underlying securities like stocks or commodities, or derivatives based on them.

Arbitrage trading programs are made possible by algorithms that can scan market rates and identify pricing anomalies in milliseconds (also known as an "electronic eye").

These systems may be programmed to identify a variety of conceivable trading possibilities and execute transactions to take advantage of arbitrage opportunities as they arise.

The program detects and utilizes relatively small pricing discrepancies between different securities. In general, mispricing of this kind can be taken advantage of by making simultaneous trades in the security at different prices.

What are bids and asks in stocks?

Bid and ask is a trader's primary reference for the price of a share. The bid is defined as the highest price which a buyer is willing to pay for a security.

The ask is defined as the least price at which a seller is willing to sell a particular stock. It represents the price at which a trade will take place.

As a trader, it is important to be aware of both the bid and ask prices when you are entering into transactions.

The bid and ask is the best way to monitor a particular stock's price movement and how it impacts your investment. This also provides you with a clear picture of how your trade is going to look.

Also read: What is expiry in Share Market?

In addition, bids and asks help you determine whether the right time is to buy or sell. As a trader, you may buy securities according to the amount of capital you have, but entry prices are not determined by your absolute level of resources.

You also have to consider the entries at a level with greater volume and liquidity, so that you will do better in your trades.

What is an upper circuit and lower circuit?

The upper circuit and lower circuit are primarily used by the stock exchange to monitor the markets for signs of manipulation.

In short, they can be viewed as a surveillance or protection mechanism that prevents market participants from having too much control over the stock prices. It also offers information about which stocks are on the rise and on the decline.

If any particular stock reaches its upper circuit or lower circuit prices, the stock exchange sends out a "circuit breaker" to protect investors. This means that if the prices are persistently reaching their upper or lower circuit prices, the exchange may stop trading in that particular stock for a few hours or for the day to safeguard the retail investors.

Also read: Jobber in Stock Market

Other actions include immediately stopping any activity that may be causing the price fluctuation or else placing a limit order that will go into effect should the upper or lower circuit prices be reached.

Conclusion

TBQ and TSQ are indicators that provide a simple measure of the liquidity of a stock either its ready marketability or else its ability to be readily converted into cash.

In addition, TBQ and TSQ are indicators that help to determine whether a stock is suitable for intraday trading or not.

Finally, the Stock market uses an upper circuit and lower circuit to monitor for signs of manipulation in the markets with a view to protecting investors and ensuring market integrity.

FAQs

TBQ Full Form?

TBQ stands for Total Buy Quantity or Total Bid Quantity.

TSQ Full Form?

TSQ stands for Total Sell Quantity.

TTQ Full Form?

TTQ stands for Total Traded Quantity.

TSQ and TBQ difference?

The difference between TSQ and TBQ is TSQ stands for Total sell quantity and TBQ stands Total Buy quantity.

TBQ meaning in share market in hindi?

TBQ एक शब्द है जिसका इस्तेमाल शेयर बाजार में कुल खरीद मात्रा या कुल बोली मात्रा के संदर्भ में किया जाता है।

What is meant by TBQ and TSQ in stock market?

TBQ means Total Buy Quantity or Total Bid Quantity and TSQ means Total sell quantity.

TSQ meaning in share market in hindi?

TSQ स्टॉक के लिए एक्सचेंज पर सभी मौजूदा बिक्री आदेशों का कुल योग है, यह TBQ के बिल्कुल विपरीत है।