In India, the depository participant (DP) is a key player in the securities market. They play an important role in the overall functioning of the market by providing various services to institutional and retail investors. In this post, we will take a closer look at the role and functions of Depository Participants in India. Stay tuned!

Depository participants are entities licensed by the Securities and Exchange Board of India (SEBI) to provide depository services to Indian investors.

The role of a depository participant is to act as an intermediary between investors and the depositories, facilitating the registration and transfer of securities.

In addition, they offer other services such as portfolio management, mutual fund distribution, and IPO intermediation. DP’s are critical in the development of India’s capital markets and play a key role in improving investor access to securities.

SEBI has been working towards enhancing the regulations governing DP’s with the goal of strengthening their operations and safeguarding investor interests.

The Role of Depository Participants

Depository participants, or DP's for short, are organizations that provide investors with a platform to trade securities and offer regular profit and loss statements. In return, DP's charge fees and keep investor shares in a dematerialized form.

The role of a depository participant is to act as a middleman between an investor and the depository. This allows investors to have a more streamlined experience when trading securities, as they can rely on the DP to provide all the necessary services.

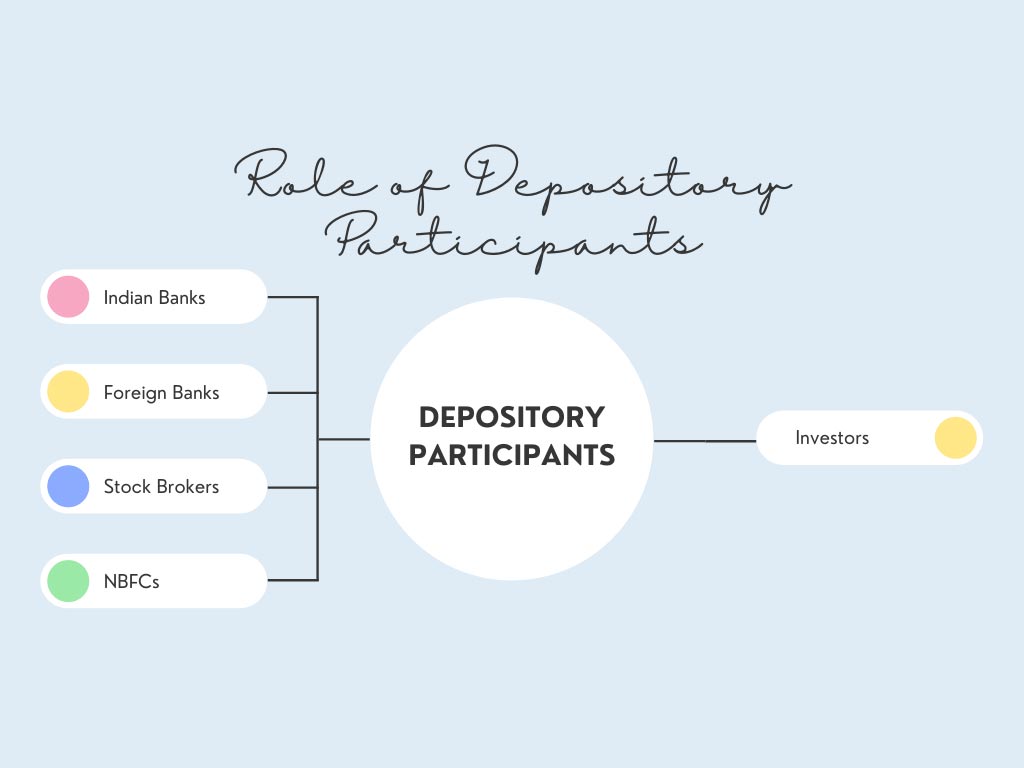

DP's can be stockbrokers, banks, non-banking financial companies (NBFCs), or any other type of organization that is authorized by the Securities and Exchange Board of India (SEBI).

Thus, investors need to research the different DP's available to them and select one that best suits their needs.

How do depository participants work?

Depository participants work by offering investors a platform to trade securities. This platform can be used to buy and sell stocks, mutual funds, and bonds.

In return for this service, DP's charge transaction fees and a Demat account fee. The depository participant's website will also provide investors with regular profit and loss statements.

It is important to note that investors' shares are kept in a dematerialized form when held with a depository participant. This means that the shares are not held in physical form, but rather they are stored electronically.

This system has many benefits, especially in the case of Demat accounts. For example, with a depository participant in place, investors do not have to worry about share certificates being lost or damaged.

Also read: What is Long and Short Buildup?

Instead, they can simply access their accounts online at any time to trade their securities, track prices, and view their statements.

Another important benefit of using a depository participant is that many DP's participate in the Depository Participant/Stock Broker Settlement System (DPSS). This system allows investors to receive the proceeds of their sales automatically in their bank accounts.

Thus, DP's provide a number of important services that investors can benefit from.

The major functions of Depository Participants

Following are some of the major functions of a Depository Participant-

1. Investors' account opening:

A DP can open an investor account, which is a necessary prerequisite to trade on the stock exchange.

2. Securities re-materialization and de-materialization:

When an investor places a sell order, the shares are temporarily transferred from the seller's account to the broker's account. The broker then delivers the shares to the buyer.

When the buyer pays for the shares, they are transferred back to the seller's account. On the other side, when an investor places a buy order, the shares are temporarily transferred from his broker's account to the seller's account. The seller then delivers the shares to the buyer.

3. Loans against shares are pledged and un-pleaded:

This is done when a shareholder uses shares as collateral for obtaining a loan. A DP acts as an intermediary and ensures the borrower's shares are transferred to the lender in case of a default.

4. The process of establishing transactions:

The setting of transactions using stock exchanges is done in connection with depositories.

5. Securities are transferred:

A DP enables the transfer of the security out of the account of a shareholder in case he has pledged it or wishes to sell it.

6. Benefits of Corporate Action:

DPs offer corporate action benefits to their customers, such as directly transferring securities into the Demat account or bank accounts of customers. This eliminates the need to deposit the securities in physical form with the company and speeds up the process.

7. Miscellaneous:

DPs facilitate other functions such as recertification, de-stamping (for properties such as immovable property and gold), transfer of shares to an heir when the shareholder dies, etc.

As per SEBI guidelines, all depository participants are required to take up corporate actions on behalf of their clients. This includes taking care of all aspects of the recertification, dematerialization, etc. of the securities out of which dividends are to be paid.

Corporate actions are all events by which companies, through their Board Of Directors or Shareholders, can decide to change the share capital structure of a company. It is an event where there are changes in the ownership rights over shares.

Difference between depository & depository participant

A depository is an entity that securely holds all of a company's shares via Demat accounts. A depository participant acts as a link between investors and depository institutions, assisting them in carrying out their responsibilities. The depository maintains a record of all shares held in a Demat account.

A depository cannot open an account directly for someone; the individual must go through the depository participant. It's the same as if you are unable to open an account with the RBI, you must open one with a bank.

After selecting a depository participant, they will give you with all of the forms necessary to open an account with the depository.

The depository participant is responsible for preserving all records pertaining to the shares held on behalf of the investor by the depository.

They are accountable for maintaining accurate and current records at all times. Additionally, the depository participant facilitates the redemption and selling of business stock.

Banks are the most common depository participants, however other financial institutions may also operate as depository participants.

In India, the two depositories are CDSL and NSDL. The National Stock Exchange, as well as other financial organisations, support NSDL. The Bombay Stock Exchange and other financial organisations support CDSL.

Depository participant vs stock broker

A stock broker assists investors in making their trading decisions. They buy and sell securities on behalf of the customer, collect and remit brokerage to the exchanges, handle paperwork, and so on.

On the other hand, a depository participant enables you to keep shares in electronic format instead of physical form. The depository participants maintain all records of your shares; they help you receive dividends directly into your account.

They ensure that your records are up-to-date by keeping track of any redemptions or transfers made.

Also read: What is Trigger Price?

Stock brokers usually provide research and recommendations about relevant stocks to their clients. They may also offer a Dealing Desk service which provides the customer with a direct line to the broker's desk so that they can buy and sell securities instantly.

Depository participants do not usually provide research or recommendations; their focus is on ensuring that your shares are in electronic form and that all processes related to corporate actions are taken care of smoothly.

Traditionally, investors believe that a stockbroker must become a depository participant in order to work with them. However, this isn't the case. The Depositories Act, 1996 and the SEBI (Depositories & Participants) Regulations, 1996 define who is eligible to become a Depository Participant.

The following are some of the entities on the list:

- Institutions of public finance

- A stock exchange's clearing house or clearing corporation.

- A stock broker who has been granted a Certificate of Registration under the SEBI Act of 1992.

- Non-Banking Financial Company with a minimum net worth of Rs.50 lakh.

- Reserve Bank of India-approved Scheduled Banks, including Foreign Banks (RBI).

- The State Financial Corporations Act of 1951 established the State Financial Corporations.

How do you choose a depository participant?

Each depository participant offers different services and charges, so it is important to compare their features before making a decision.

Be sure to read all the fine documents, as some DP's may have hidden fees. The account opening process should be simple and straightforward, with no hidden requirements.

When choosing a depository participant, you should consider the following:

The list of charges:

Be sure to understand all the fees that will be charged, and whether there are any hidden costs. The services that are included in the costs should also be identified.

The account opening process:

Check whether the account opening process is online or offline, how long it takes, and what are the requirements. It is advisable to open an account with a participant that requires simple documentation, as you will avoid delays in opening your account.

Customization possibilities:

Some depository participants offer customized services for clients who have specific needs. If these services are important to you, make sure they are offered by your preferred DP.

User interface:

The User Interface, or UI, refers to the way a web page is presented to you when you log in to it. The user interface of a depository participant may be important if you have specific requirements that need to be met. The web platform should be easy to navigate and understand.

User-friendly mobile application:

If you use your mobile phone for trading, it is important to look for a depository participant that offers an easy-to-use application on your mobile device.

Process of transferring certificates:

Transferring certificates must be simple and straightforward, with no hidden requirements. The DP of the original company may have limitations regarding this matter, so it is important to find out about this before transferring your certificates.

Investing and analytical services:

Some DP's offer a wide range of investing and analytical services, while others specialize in certain areas. If you need help with your investment portfolio or want to get more information about specific markets, choose a depository participant that offers the services you require.

The List of Depository Participants in India:

These are some of the well-known Depository Participants in India

Sharekhan:

Sharekhan is one of the leading stock brokers in India and offers a wide range of services to its clients, including depository participant services.

Zerodha:

Zerodha is a discount stock broker that offers trading and investment services at a fraction of the cost charged by traditional brokers. It also offers depository participant services.

Upstox:

Upstox is a leading stock broker and offers depository services to its customers.

India Infoline: India Infoline is a comprehensive financial services provider that offers depository services to its customers.

Angel Broking:

Angel Broking is a well-known stock broker in India and offers depository participant services to its clients.

Reliance Securities:

Reliance Securities is a subsidiary of Reliance Capital and offers a wide range of financial services, including depository participant services.

ICICI Securities:

ICICI Securities is a leading securities firm in India and offers depository participant services to its clients.

Motilal Oswal:

Motilal Oswal is also another leading financial services provider in India and offers depository participant services to its clients.

You can check the details of all the registered Depository Participants in India by visiting the following links NSDL Depository Participants and CDSL Depository Participants.

Conclusion

The role and functions of a depository participant in India are not limited to providing services for securities.

They also provide the infrastructure for financial market participants, intermediaries, and investors by maintaining their accounts with Central Depositories or other depositories designated as such by SEBI from time to time.

In addition, they undertake settlement activities including clearing and payment obligations arising out of transactions between members on behalf of themselves as well as others.

By undertaking these responsibilities, Depository Participants play an important role in ensuring efficient functioning of Indian capital markets which is essential for economic growth.

Thank you for reading this article and we hope that it has been interesting and informative. If there is anything else we can help with, please don't hesitate to contact us!

FAQs

Q: What are the responsibilities of a depository participant?

A: A depository participant is responsible for providing services to securities holders, maintaining accounts with Central Depositories, and undertaking settlement activities.

Q: What should I consider when choosing a DP?

A: When choosing a DP, you should consider the list of charges, the account opening process, customization possibilities, the user interface, the customer-friendly mobile application, and the process of transferring certificates.

Q: What are some examples of investing and analytical services?

A: Examples include services related to stock research or market predictions. Some DP's may also offer portfolio management services.

Q: What is the relationship between depository and depository participants?

A: Depositories allow investors to electronically hold their securities in a dematerialized form. Central Depositories are entities that are responsible for holding the underlying securities in electronic form on behalf of their members.

Whereas Depositories participants are entities that have been granted the rights by a depository to carry out settlement, trading, and custody services on its platform. They are also responsible for providing dematerialization and rematerialization services.