In the sprawling universe of financial tech, a new star has emerged on our screens: the NAVI Loan App. As money and time intertwine more than ever, knowing whether this shining beacon is genuinely a saviour or merely a mirage in the vast digital desert is crucial.

Before you tap ‘install’ and trust this app with your hard-earned cash, let’s dive deep and unearth the real story behind NAVI. Should you swipe right or left? Read on, and I’ll guide you through the maze.

The digital age has blessed us with a cornucopia of apps, each promising to make our lives easier, more efficient, and, sometimes, more prosperous. But as our virtual wallets swell with these financial tools, so does our responsibility to safeguard our financial health.

With every new entrant like NAVI, the pressing question arises: Is this app worthy of our trust, or is it just another fleeting trend riding the wave of digital fascination?

We’ve all heard stories of those who’ve struck gold with the right financial tools and those who’ve plummeted into the abyss with the wrong ones. Your decision today can be a stepping stone to your financial dreams or a stumbling block to regret.

Let’s embark on this journey together and dissect the NAVI Loan App, piece by piece, ensuring that your next financial move is informed, confident, and, above all, safe.

What is the NAVI Loan App?

Enter the realm of rapid financing, and you’ll inevitably stumble upon the NAVI Loan App, a brainchild of Sachin Bansal, the former CEO of Flipkart, who introduced it to the financial technology sector in 2020.

Standing out in a saturated market, NAVI quickly garnered attention as one of the pioneers in providing instant loan approvals, offering users the chance to secure loans up to Rs 5 lakh with just a few taps on their screens.

Boasting a user-friendly interface, the app makes navigating your financial needs a breeze, eliminating the age-old hassles of cumbersome paperwork.

Also read: Is Cred App Safe?

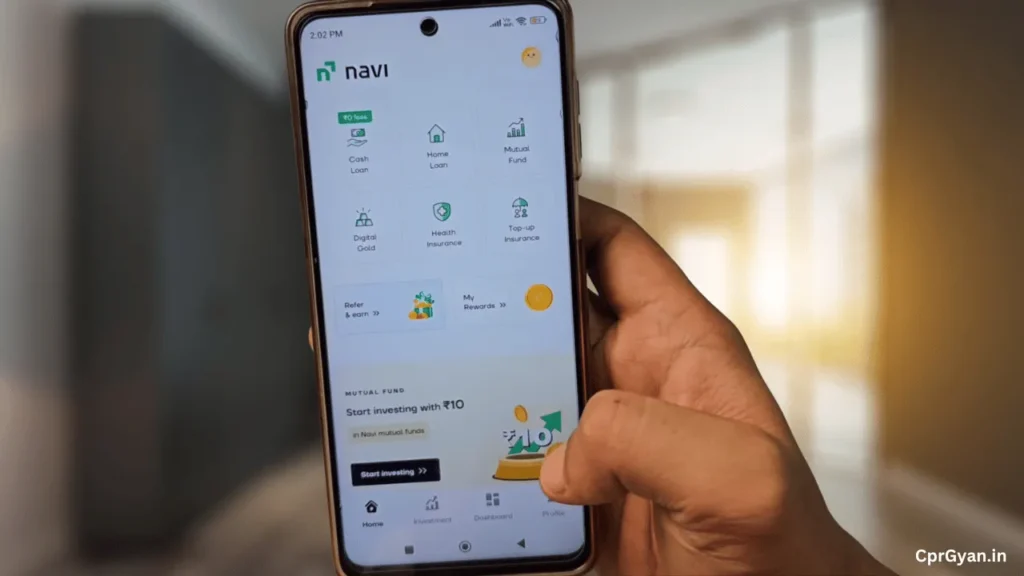

But NAVI isn’t just confined to Android enthusiasts; Apple fans can also get in on the action, as the app is readily available on iOS and Android platforms. Beyond its loan offerings, NAVI extends its financial expertise into other domains, including health insurance and mutual funds.

Were you interested in a home loan? NAVI’s got you covered with interest rates commencing at a competitive 8.55% p.a., allowing loans up to a whopping five crore with a flexible tenure spanning 30 years.

On the personal loan front, prospective borrowers can anticipate interest rates ranging from 9.9% to a steep 45%, with the freedom to seek loans up to 20 lakhs over a maximum of 72 months.

Whether it’s a dream home, a personal project, or safeguarding your health, NAVI seems poised to be a versatile companion in your financial journey.

What are the features of NAVI Personal Loan?

Navigating financial necessities is often daunting, but NAVI Personal Loan has transformed the ordeal into a seamless experience. Let’s delve into the unique features that make it stand out:

- Competitive Interest Rates: With rates oscillating between 9.9% and a maximum of 45%, NAVI ensures a broad spectrum to accommodate varied financial profiles.

- Generous Loan Amount: NAVI covers whether you seek a modest or more substantial sum. Borrowers can request anything from Rs 5,000 to an impressive cap of ₹20 lakh.

- Lightning-fast Disbursal: Gone are the days of nail-biting waits. Eligible users can rejoice in having the requested amount swiftly transferred to their bank accounts within mere minutes of approval.

- Paperless Paradigm: NAVI champions an eco-friendly, hassle-free process. From the initiation to the culmination, the entire loan procedure is digitalized, eliminating the need for cumbersome paperwork.

- Repayment on Your Terms: Catering to diverse financial backgrounds, NAVI offers a flexible repayment structure. Users can opt for convenient EMIs for 6 years or 72 months.

- Minimalist Documentation: No more shuffling through files and folders. All that’s needed to kickstart your loan process is your PAN card, streamlining the approval journey.

- Unsecured Loans: Borrow with peace of mind, as NAVI Personal Loans don’t demand collateral or guarantors. Your eligibility criteria solely dictate your loan amount and interest.

- Tailored to Your Needs: Every individual has unique financial aspirations and emergencies, whether addressing a medical necessity or funding a leisurely staycation. NAVI ensures your needs are met with precision.

What are the features of NAVI Home Loan?

The timeless adage goes, “Home is where the heart is.” But in today’s complex financial landscape, it’s often the case that “Home is where the loan is.”

NAVI Home Loan seeks to demystify the home loan process, offering a comprehensive package tailored for those aspiring to own or renovate their dream abode.

Here are the standout features that make NAVI Home Loan a contender in the housing finance domain:

- Generous Loan Cap: Whether you’re setting your sights on a quaint apartment or a luxurious mansion, NAVI is ready to support your ambition, offering loans ranging from ₹10 lakhs to an astounding ₹5 Crore.

- Competitive Interest Rates: With interest rates commencing at an attractive 8.55% p.a., NAVI ensures borrowers enjoy value-driven deals that don’t break the bank.

- Extended Repayment Tenure: Offering unparalleled flexibility, borrowers can comfortably spread their repayments over 30 years, alleviating the pressure of hefty monthly payouts.

- Understanding Home Loans: For the uninitiated, a home loan represents funds borrowed for purchasing, constructing, or renovating homes. As a secured loan type, it necessitates collateral, ensuring lenders have a safety net.

- Accessible Repayment Mode: NAVI’s EMI system allows borrowers to repay their loans in consistent monthly instalments, offering predictability and ease of financial planning.

- Taxation Perks: Beyond facilitating home ownership, NAVI’s home loan offers the added advantage of tax deductions. Borrowers can enjoy tax benefits under Sections 80C, 24B, 80EE, and 80EEA, providing a dual advantage of property acquisition and fiscal savings.

In a world where homeownership often seems a distant dream, NAVI Home Loan emerges as a beacon of hope, simplifying the path to property ownership with its transparent, accommodating features. Your dream home is no longer just a figment of imagination; with NAVI, it’s a palpable reality.

The Pros and Cons of Taking a Loan from NAVI Loan:

In the ever-evolving landscape of fintech, the NAVI Loan App has emerged as a prominent player, streamlining the loan acquisition process for thousands.

But, as with every financial tool, it’s essential to weigh its merits against its drawbacks to make an informed decision. Here’s a breakdown of the pros and cons when considering a loan from NAVI:

Pros:

- Instant Disbursal: One of NAVI’s most applauded features is its ability to transfer funds within minutes upon approval, ensuring you get your funds precisely when needed.

- Paperless Transactions: NAVI has masterfully harnessed the power of digitalization, making cumbersome paperwork a thing of the past. This speeds up the loan process and ensures a hassle-free experience.

- Flexible Repayment Options: Offering repayment tenures spanning a few months to 30 years, NAVI caters to diverse financial profiles, ensuring borrowers find a plan that fits their unique situation.

- Attractive Interest Rates: For home loans, NAVI’s starting rate of 8.55% p.a. is competitive, potentially translating to significant savings over the loan’s lifespan.

- Minimal Documentation: With just essential documents like a PAN card required, the loan application process becomes straightforward and swift.

Cons:

- Varied Interest Rates for Personal Loans: While the starting rate for personal loans might seem attractive, they can stretch up to a steep 45%. This wide range can result in some borrowers paying considerably more over time.

- Collateral Requirement for Home Loans: Being a secured loan, the home loan requires collateral, which might be a deterrent for some potential borrowers wary of pledging assets.

- Digital Dependency: The entirely app-based process, while revolutionary, might pose challenges for those not tech-savvy or without reliable internet access.

- Potential Hidden Charges: As with many loan apps, users should be cautious and fully understand any additional fees or charges that might not be overtly advertised.

While the NAVI Loan App offers various features that make loan acquisition more straightforward and user-friendly, potential borrowers should tread cautiously, thoroughly research, and understand the terms before committing. Every financial decision, big or small, deserves a well-informed approach.

What are the Eligibility Criteria for NAVI Loan?

Venturing into the realm of loans can often feel like navigating a maze, especially when understanding if you’re a fitting candidate.

In its quest to simplify lending, the NAVI Loan App offers clear eligibility criteria for its various loan offerings. Let’s unravel what it takes to be a suitable contender:

For Home Loan:

- Nationality: The foremost criterion is that the applicant should be an Indian Resident, ensuring familiarity with the country’s real estate nuances.

- Occupation: NAVI Home Loan targets the salaried segment, allowing them to turn their dream home into reality.

- Age Bracket: Catering to a wide demographic, the age requirement stands between 22 to 62 years. This range ensures the young, aspiring homeowner and the seasoned professional find a place under NAVI’s umbrella.

For Personal Loan:

- Nationality & Age: At the outset, the applicant must be an Indian Citizen, falling within the age spectrum of 21 to 65. This broad bracket ensures the loan caters to diverse life stages and needs.

- Essential Documents: As proof of identity and financial credibility, a valid Aadhaar Card and PAN card are imperative. These serve as primary identification, simplifying the verification process.

- Occupational Flexibility: Whether salaried or steering your enterprise, NAVI’s Personal Loan is designed to cater to both, extending its reach to a vast working class.

- Income Benchmark: An annual income exceeding 3 Lakh is mandated, ensuring the borrower’s capacity to repay the loan.

- Credit Standing: A CIBIL score, a reflection of one’s creditworthiness, plays a pivotal role. NAVI mandates a score greater than 750, indicative of a commendable financial history and discipline.

Though comprehensive, NAVI’s eligibility criteria are designed to be inclusive, resonating with a broad spectrum of potential borrowers. If you align with the stipulations, the pathway to acquiring a loan with NAVI is a streamlined journey awaiting your exploration.

How to Apply for a Loan on the NAVI Loan App?

In today’s fast-paced digital age, accessing financial tools should be as effortless as tapping a button on your screen. NAVI Loan App, championing this mantra, has seamlessly integrated the loan application process into a few straightforward steps.

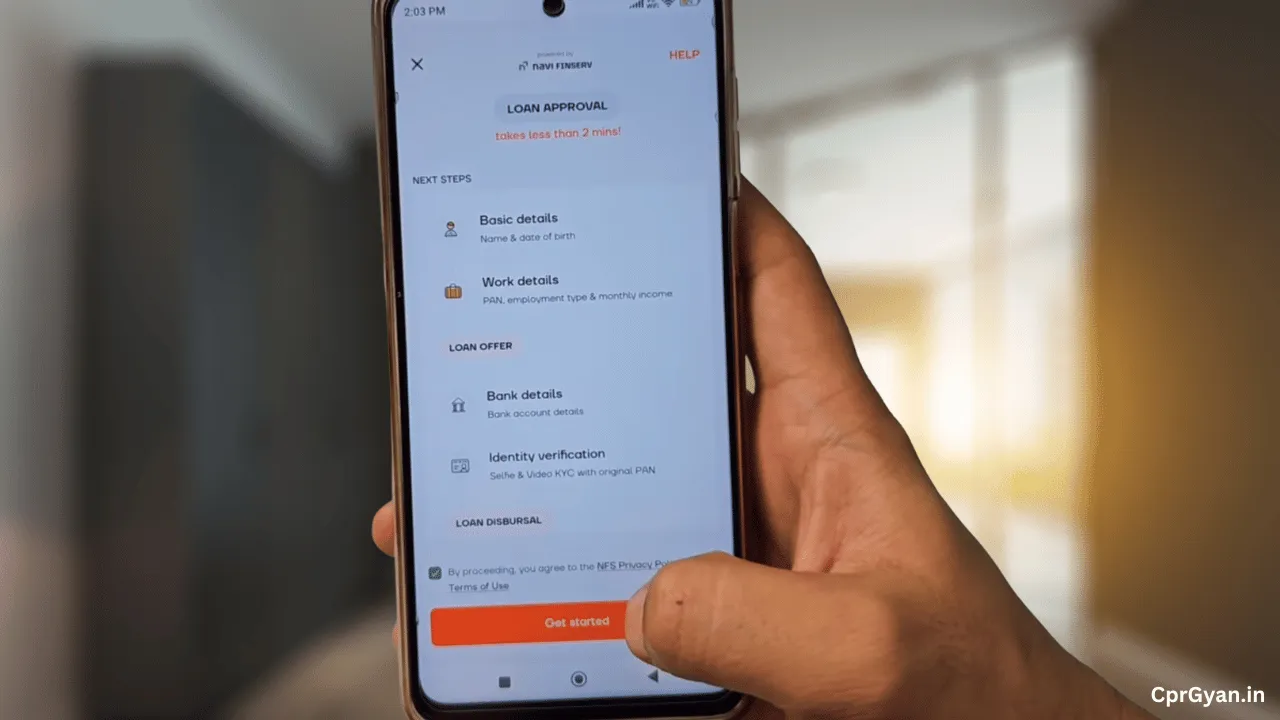

If you’re pondering over how to embark on your loan journey with NAVI, here’s a step-by-step guide to lead the way:

- Download the App: Kickstart the process by heading to your respective app marketplace, whether the Play Store for Android users or the App Store for iOS users. Search for “NAVI Loan App” and hit the download button.

- Check Eligibility: Once the app graces your device, launch it and key in some rudimentary details. This preliminary step provides a swift assessment, giving insights into your loan eligibility.

- Decide Loan Specifics: After passing the eligibility checkpoint, it’s time to fine-tune your loan details. Input your desired loan amount and the repayment tenure that aligns with your financial planning.

- Video-KYC Procedure: NAVI introduces a Video-KYC method to ensure authenticity and maintain security. Here, you’d be required to showcase your PAN and Aadhaar cards, followed by a quick selfie. This digital verification negates the need for any physical documentation, amplifying convenience.

- Input Banking Details: To ensure a smooth funds transfer and repayment mechanism, key in your bank account details. Further, set up the auto-pay feature, a nifty tool that automates the EMI deductions, ensuring timely payments sans any hiccups.

- Watch the Magic Unfold: With all formalities wrapped, brace yourself for almost instantaneous Magic. If all criteria align, the requested funds will swiftly be transferred to your bank account, making your financial aspirations a palpable reality.

NAVI Loan App’s application process is a testament to how technology, when wielded right, can revolutionize traditionally cumbersome procedures. Financial empowerment is a few taps away with this app in your arsenal.

Is the NAVI Loan App Safe to Use?

In an age where digital convenience is often paralleled with security concerns, an app’s safety becomes paramount, mainly concerning finances.

NAVI Loan App, acutely aware of these concerns, has fortified itself with a suite of features to ensure robust security and maintain user trust. Let’s delve into the specifics that stand testimony to its commitment to safety:

- Data Privacy Policies: At the foundation of NAVI’s approach to user safety lies its stringent data privacy policies. These policies ensure that all personal, financial, or transactional user data is confidential. The app is designed to collect only what’s necessary and ensures that this data is neither misused nor shared with third-party entities without explicit user consent.

- Encryption and Protection Features: NAVI understands the sanctity of financial data. It employs state-of-the-art encryption techniques like those used by leading global financial institutions. This ensures that any information you share—like your bank details, PAN, Aadhaar, or transaction history—remains encrypted, rendering it useless to any potential hacker or malicious entity.

- Authentication Processes: Beyond data protection, NAVI ensures that access to its app remains fortified against unauthorized entries. This is achieved through rigorous authentication processes. Users are often required to verify their identities through multi-factor authentication, encompassing passwords, OTPs, and sometimes even biometric verifications. This layered approach ensures that only the rightful user gains access, keeping potential intruders at bay.

While the allure of digital convenience often comes with the looming shadow of security concerns, NAVI Loan App has yet to leave any stone unturned in its bid to offer a secure environment.

So, if you’re on the fence about its safety, rest assured that NAVI’s technological and policy-driven shields are up and robust, ensuring your financial journey remains smooth and secure.

Is the NAVI Loan App Legit?

With the digital realm flooded with countless apps offering myriad services, discerning legitimacy can often feel like finding a needle in a haystack.

So, when it comes to financial undertakings like loans, a common question posed by potential users is: “Is this platform genuine?” For those contemplating the NAVI Loan App’s authenticity, here’s a comprehensive examination:

NAVI Loan App isn’t just another player in the crowded financial market; it’s backed by the prowess of Sachin Bansal, the ex-CEO of Flipkart—a name that holds significant weight in the Indian e-commerce and tech arena. Its genesis aimed to revolutionize how people borrow and instil trust and transparency in the process.

The app has continually demonstrated compliance with all regulatory requirements set by financial authorities in India. It operates under the nation’s financial regulations, ensuring every transaction, interest rate, and user interaction aligns with the established norms.

Furthermore, the testimonials and reviews of countless users provide empirical evidence of the app’s legitimacy. Consistent feedback speaks volumes about timely loan disbursals, transparent interest rates, and an efficient customer service mechanism, all hallmarks of a legitimate financial service provider.

Lastly, the technology infrastructure, user data protection mechanisms, and affiliations with recognized financial institutions further underscore NAVI’s position as a bona fide entity in the lending sphere.

To wrap it up, while scepticism in the digital age is warranted, the NAVI Loan App stands tall, proving its legitimacy repeatedly. It’s not merely a tool; it’s a testament to how tech-driven solutions, anchored in trust and authenticity, can reshape the financial landscape for the better.

Customer Reviews and Ratings on the NAVI Loan App:

Navigating the intricate world of financial apps can be challenging, especially when determining which best fits your needs. But the voice of the masses, often encapsulated in ratings and reviews, provides a beacon of clarity. A telling narrative unfolds when examining the NAVI Loan App through the lens of user feedback.

Sporting a commendable rating of 4.3 stars out of 5 on both the behemoth platforms of Google Play Store and the Apple Store, the NAVI Loan App has struck a chord with its user base.

This impressive score isn’t a result of a handful of reviews; an extensive volume of feedback backs it. A whopping 7 lakh individuals have voiced their opinions on the Google Play Store alone, supplemented by an additional 14,000+ reviews from the Apple community.

This sheer magnitude of feedback is not only indicative of the app’s widespread reach but also its consistent performance. A deep dive into these reviews reveals a tapestry of experiences:

- Stories of timely financial assistance

- Appreciation for the app’s user-friendly interface

- Admiration for the seamless approval processes

Of course, as with any product or service, there are bound to be areas of improvement, but the overwhelming sentiment leans positive.

NAVI Loan Customer Support and Contact Details:

One of the most crucial elements defining any financial service’s credibility and reliability is its approach to customer support. An establishment’s readiness to address the concerns and queries of its users is paramount.

NAVI Loan App has established a structured mechanism to ensure its users feel heard and assisted at every step.

Grievance Redressal Officers: To streamline the process and offer specialized solutions, NAVI has designated two Grievance Redressal Officers.

- Mohammed Jaffer Sadiq

- Designation: Grievance Redressal Officer (DLA)

- Address: Navi Finserv Limited, 2nd Floor, Vaishnavi Tech Square, Iballur Village, Begur Hobli, Bengaluru, KA 560102

- Email: grievance@navi.com

- Abhijeet Paul

- Designation: Customer Grievance Redressal Officer (LSP)

- Address: Navi Technologies Limited, 9th Floor, Vaishnavi Tech Square, Iballur Village, Begur Hobli, Bengaluru, KA 560102

- Email: grievance.ntl@navi.com

For more general queries or to initiate support conversations, NAVI also has a dedicated contact avenue:

- Email: help@navi.com

NAVI Loan App emphasizes transparent communication and swift resolution of concerns. By demarcating roles and ensuring ease of access to their support team, NAVI provides its users with the assurance that should they encounter any hiccups, there’s a robust system in place to guide and assist them.

Conclusion:

In an age where the line between genuine utility and digital gimmickry blurs more each day, apps like NAVI don’t just offer a service; they pose an essential question: In finance, can technology indeed merge convenience with trust?

With its sturdy architecture, transparency, and user-centric approach, NAVI suggests such a blend is possible.

It’s tempting to see financial apps as digital tools, but they also reflect societal progress. The freedom to access funds, apply for essential financial assistance from the comfort of our homes, and receive instant support is more than convenience—it’s a shift in financial empowerment.

Yet, as with all tools, its potency lies in its use. And that responsibility rests with us, the users.

So, as you ponder upon NAVI or any digital solution, ask about its features or credibility and the change it signifies.

As a society, are we moving closer to a future where finance is not just about numbers but accessibility, inclusivity, and empowerment? The actual legitimacy of an app lies not just in its code but in the transformation it heralds.

FAQs

Who is behind the NAVI Loan App?

Sachin Bansal, the former CEO of Flipkart, launched the NAVI Loan App. Given his reputation and significant role in India’s e-commerce evolution, the app is backed by a credible and well-recognized name in the tech industry.

How quickly can I expect loan approval and disbursal?

One of the standout features of the NAVI Loan App is its instant loan disbursal process. Once you’re deemed eligible and your documentation is in order, you can expect the loan amount to be credited to your bank account within minutes.

Is my personal and financial data safe with the NAVI Loan App?

Absolutely. NAVI places a high premium on data security. They have encryption and protection features to ensure user data is safeguarded. Additionally, their authentication processes further secure transactions and user interactions.

What kind of loans can I apply for on the NAVI Loan App?

NAVI offers various financial services, including home loans, personal loans, mutual funds, and health insurance. Depending on your needs and eligibility, you can apply for loans ranging from smaller personal amounts to significant home loans.

NAVI prides itself on transparency. However, it’s always recommended to thoroughly read the terms and conditions and any fine print when applying for loans. If you have any specific queries about fees or charges, their customer support team is available and accessible to provide clarifications.