In this blog post, we will be talking about the importance of understanding your position when you trade in Zerodha. You can find out what a convert position is and how it can help you in your trading.

What is Convert Position in Zerodha?

The convert position feature in Zerodha is a great way to convert your position from a margin trade (MIS) to cash and carry (CNC) or vice-versa.

In case you have been investing without converting positions previously, now is the time for you to take note that it's an important feature if you want to go long-term with your positions.

Why do traders use this convert position option in Zerodha?

Following are some reasons when most of the traders use this conversion option in Zerodha

1. Suppose you have made a mistake and your intraday MIS trade is currently in a loss at the end of the day, now with the help of this convert position feature you can convert the MIS trade into a CNC trade and hold the shares for tomorrow. If you change your position to CNC, this will carry your whatever loss or profit to the CNC trade.

2. The second scenario is when most of the traders use this convert position feature when they buy any stock at MIS order for Intraday purposes but they see a good return already on that particular day. So, they convert their MIS trade to a CNC trade by using the convert position in Zerodha.

3. Suppose you have purchased some stocks of a particular company at CNC and suddenly some bad news about the company arrived during the day. So, you may convert your CNC trade into an MIS trade by using the convert position option in Zerodha. This way you can save yourself from all the other additional costs that you need to pay in a CNC trade.

4. The fourth case is simply opposite of the third case, suppose there is good news about the company and the price of the shares that you have bought has gone up and already given the profit that you expected. So, you can convert it into an MIS for the day by using the convert position feature in Zerodha or Kite platform so that all your profits get added to the MIS account at once.

Also read: What is TPIN in Zerodha?

How to use the convert position option in Zerodha?

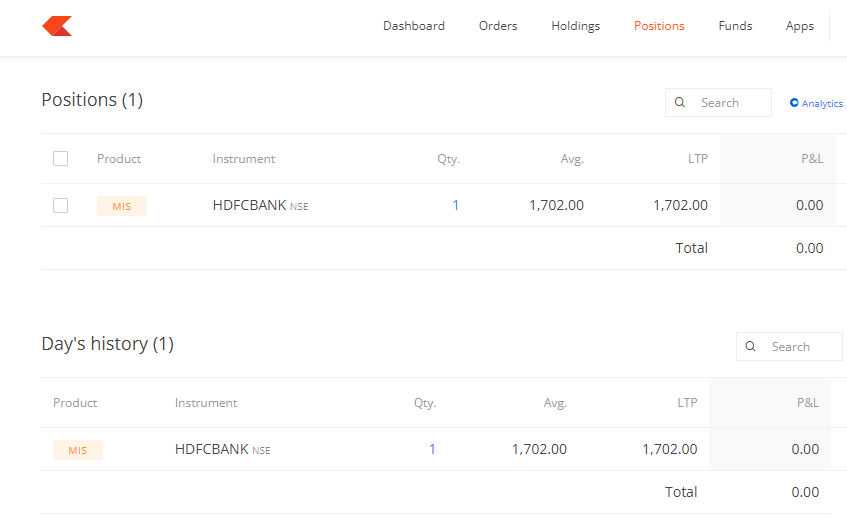

For example, you have bought some shares of HDFC Bank at MIS order for doing an Intraday trade in the early hours and decided to sell them after 3 to 4 hours on the same day, but after 3 to 4 hours your mind has changed for any reason and now you want to hold those shares for a week or a long period.

You can do so by converting your MIS trade into a CNC trade using the convert position in Zerodha, just go to the position section on the Zerodha dashboard or kite application.

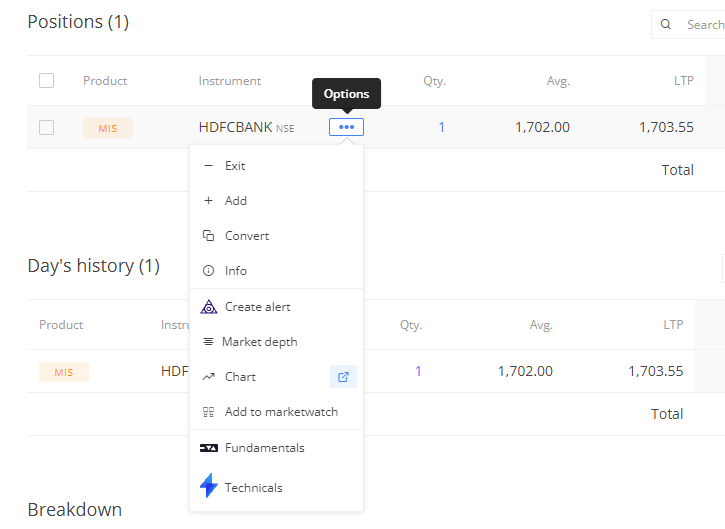

In the open positions, you will see your shares of HDFC Bank, there are three dots on the right-hand side. Click on them, and a drop-down menu will appear as shown in the image below. You can see that there is an option called the Convert, simply click on it to convert your position.

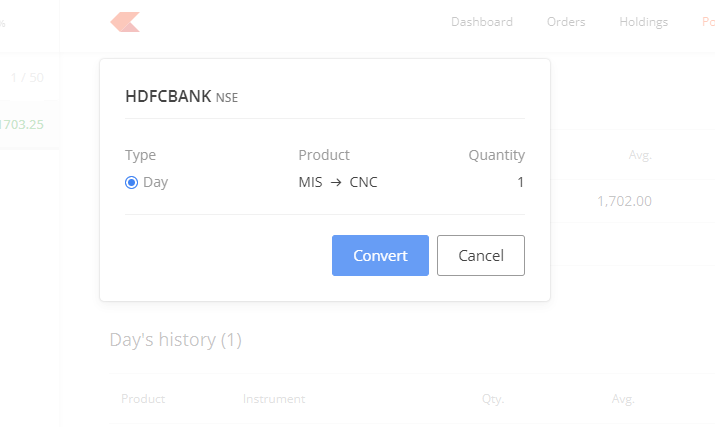

Once you click on it, another pop up will appear like show below. Click on the Convert button to convert your positions or else click on the Cancel button to cancel it.

Similarly, follow the same steps as mentioned above to convert your CNC trade to MIS.

Traders, please keep in your mind that you can not convert an MIS order to CNC after 3:20 p.m., Zerodha will terminate your position automatically.

Since MIS orders are only for that particular day and you can not hold it for the next day, so either exit the order or convert your positions to CNC before 3.20 p.m. If you fail to do so Zerodha will charge you an INR 50 Rs fine per order.

Charges for the Convert Position option in Zerodha

There are no extra charges by Zerodha for converting your trades from CNC to MIS or MIS to CNC. However, the other brokerage and SEBI charges will remain the same.

What is the convert position in options?

The convert position is an options strategy that has to do with converting a call option into a put option.

This happens when the market price of the underlying asset drops below the strike price on expiration, meaning it's in-the-money.

While this may seem like bad news for someone who owns calls (and good news for those who own puts), it can be a good thing if bought in the right situation.

This is because the position makes money regardless of whether the market goes up or down, which means it's a great strategy to use when you think that your underlying asset won't go too far either way.

Conclusions

I hope this article helped you to understand the Convert Position feature in Zerodha.

This is an easy way of changing your position without having to buy or sell any securities. In this article, I tried to explain everything about how the convert option works, what it costs, and how it can be used.

Let me know if you would like some more information on these topics! Are you using this convert position feature in Zerodha? Put your answers in the comment box below.

Also read our other articles:

How to add CPR Indicator in Zeodha kite