Hey there, food and finance lovers! Have you ever asked yourself, ‘Can I buy shares of my favorite food delivery app, Swiggy?’ Well, you’re in the right spot.

We’re here to answer just that. This blog is your one-stop shop to determine if Swiggy has jumped into the stock market. Whether you’re a keen investor or just someone who loves to keep up with the world of startups, this blog post has something for you.

We will serve up a full plate of easy-to-understand insights on this fun mix of food and finance. So sit back, get comfy, and dive into this tasty topic together. Ready? Let’s go!

What is Swiggy? (Overview of The Company)

Let’s dive into the mouthwatering world of Swiggy! This wonder of an app has been feeding our food cravings since 2014. So, what is Swiggy, you ask? It’s an excellent food delivery startup that started right in the heart of India, Bengaluru.

Picture this; you’re at home, work, or college, and your stomach grumbles for your favorite dish. All you do is whip out your phone, tap on the Swiggy app, and your food is on its way.

From your local pizza joint to the famous bakery down the street, Swiggy has them. And it’s not just food; Swiggy brings you the perfect cup of coffee or the most refreshing drinks at your doorstep.

Also read: Best youtube channels to learn stock market

You pick what you want, order it through the app, sit back, and relax. Within minutes, your favorite meal is delivered hot and ready to enjoy.

So, why is Swiggy so popular? Well, it’s simple. Swiggy lets us enjoy the tastes we love without stepping a foot out of the door. Whether it’s the middle of a busy workday or a lazy Sunday afternoon, Swiggy makes meal times easy, and that’s why we love it!

How Is Swiggy Expanding Its Business?

Let’s examine how Swiggy is spicing things up and expanding its business. Swiggy isn’t just a one-trick pony; it’s constantly evolving and growing. Part of its secret recipe for success has been buying up other companies.

It’s added five different businesses to its Swiggy family so far, with the latest addition being Dine Out, bought for a hefty sum of $200 million.

Alongside Dine Out, Swiggy also brought Kint, Supr Daily, Scootsy, and 48East under its wing. Each of these additions brought something unique to Swiggy’s table, helping it offer more options and better service to its customers.

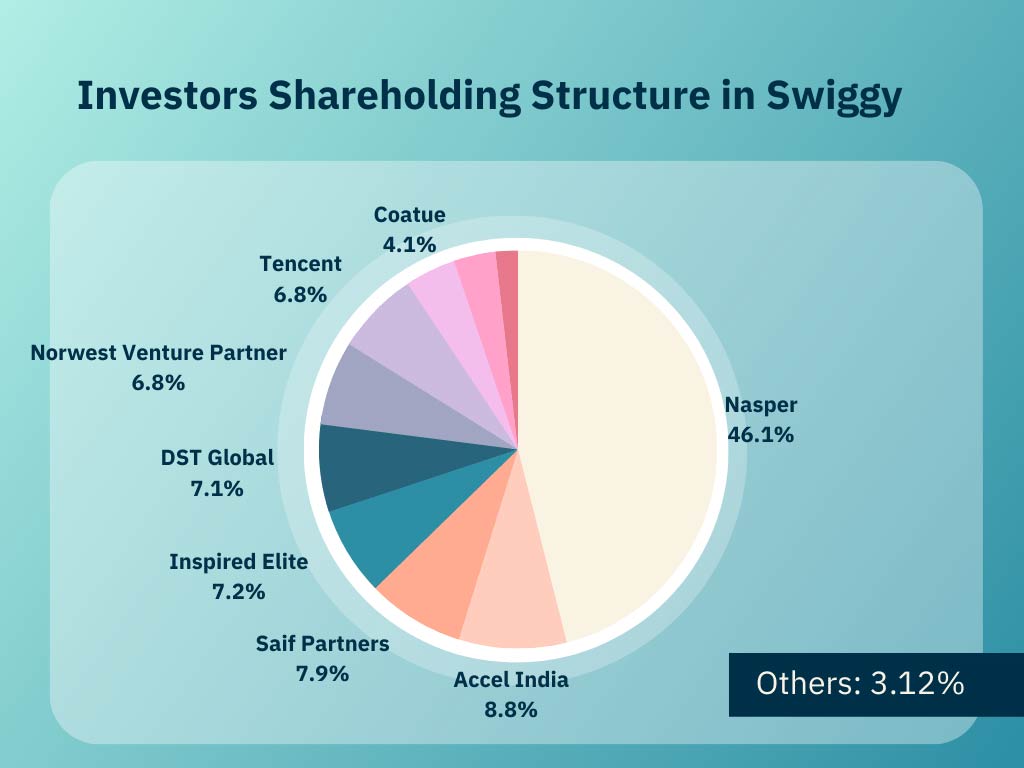

And it’s not just acquisitions. Swiggy has a robust backing of 40 investors who believe in its potential. Among these supporters, 14 are lead investors keen to see Swiggy soar.

Big names like Wellington Management, Tencent Holdings, Samsung Ventures, Accel, and Norwest Venture Partners & SAIF Partners have poured funds into this ambitious startup.

So, the next time you order through Swiggy, remember it’s not just delivering your food. It’s constantly cooking up new ways to grow bigger and serve you better!

Is Swiggy Listed In the Stock Market?

Now let’s bite into the big question we’ve all been waiting for – ‘Is Swiggy listed in the stock market?’ The short and simple answer is – it still needs to be.

In India, for a company to be considered public or listed, it must have its shares up for grabs on either the Bombay Stock Exchange (BSE) or the National Stock Exchange (NSE). And Swiggy still needs to take that step.

Now, let’s take a quick detour and peek at Swiggy’s main rival – Zomato. Zomato, founded four years before Swiggy, is a public company. It stepped into the stock market world in July 2021.

They started with a bang, setting the share price between ₹72 and ₹76, but they opened at a stunning ₹126 per share. However, it’s been a bumpy ride for them since, with their share price dipping consistently.

Swiggy and Zomato rule the roost in India’s food delivery market, holding a massive 90% share. So, while Zomato’s been riding the stock market rollercoaster, Swiggy has yet to hop on. Keep your eyes peeled because when it does, it will surely be thrilling!

Swiggy Plans To Get IPO Ready by The end of 2023:

Let’s put on our future-gazing glasses and peek into Swiggy’s plans. Word on the street is that Swiggy is preparing for its big debut on the stock market.

The rumor mill, including insiders at Entrackr.com, say Swiggy is gearing up for an IPO by September this year. However, the official papers might take another 6-8 months to hit the desks of India’s stock regulators.

The board at Swiggy has reportedly set a clear path to step into the public spotlight after the third quarter of 2024. Yes, you heard it right! Swiggy might soon join its arch-rival Zomato on the public market stage.

But that’s not all. Swiggy is also trimming down its spending as part of this grand plan. It has cut down its monthly expenses in the food delivery business to under $5 million.

Plus, the company aims to break even in the food delivery sector by April-May this year. That’s some severe financial fitness right there! So, watch this space because if these plans become a reality, Swiggy’s journey will get even more exciting!

Swiggy vs Zomato: The Public Listing Showdown

It’s time to stir up some friendly competition as we compare Swiggy with its main rival, Zomato. Both have been fighting it out for the top spot in India’s food delivery market, but there’s one big difference – Zomato has already gone public.

Zomato threw its hat into the stock market ring in July 2021. They priced their shares between ₹72 and ₹76 but kicked off their first trading day with a much higher price of ₹126 per share.

It was a bold start, but their journey since then has been a roller coaster ride, with their share prices sliding down consistently.

On the other hand, Swiggy is yet to join the stock market party. It’s still a private company with no shares up for grabs on the stock market. But, as we’ve learned, Swiggy might be planning its grand entrance into the public markets shortly.

So, in the public listing showdown between Swiggy and Zomato, Zomato took the first leap. But the big question remains – when Swiggy does jump in, will it soar higher? Only time will tell!

Conclusion:

And there you have it, folks! The simmering scoop is whether Swiggy has made its mark on the stock market. As we’ve discovered, Swiggy still needs to be listed on the stock market yet. But there are strong whispers of a grand entry brewing shortly.

This delightful journey, hopping between the realms of food and finance, shows us how intertwined our daily lives are with the business world. Who knew the app you use to order your favorite biryani could be a hot topic for investors?

While Swiggy continues to whip up a storm in the food delivery world, seeing how its potential public listing could spice up the stock market will be interesting. Swiggy’s entrance could bring a new flavor to the financial feast.

Will it be a recipe for success or a too-spicy-to-handle affair? That’s a question only time (and your next food delivery order) will answer! As the Swiggy saga unfolds, we’ll serve you the latest updates from the oven. Until then, keep munching and investing, one bite and one share at a time!

FAQs:

Q: What is an IPO, and how does it work?

A: An IPO, or Initial Public Offering, is when a company decides to sell its shares to the general public for the first time. It’s a way for the company to raise funds for growth and expansion. During an IPO, the company decides on the number of shares it wants to sell and sets a price range. Then, people can start buying these shares, effectively owning a small part of the company.

Q: Why has Swiggy yet to go public?

A: The decision to go public is strategic, made by a company’s board of directors and stakeholders. Swiggy may have chosen to remain private for various reasons, such as maintaining control, avoiding public scrutiny, or having sufficient funds from private investors for its current needs. However, as per recent reports, Swiggy is gearing up to become IPO-ready.

Q: How can I invest in Swiggy once it goes public?

A: Once Swiggy goes public and lists its shares on the stock exchange, you can buy them through any brokerage or trading account like Zerodha or Upstox.

Q: How will Swiggy’s IPO impact the food delivery market in India?

A: An IPO from Swiggy can significantly impact the food delivery market. It could attract more investments into the sector, stimulate competition, and lead to better consumer services. However, it’s also possible that increased financial scrutiny could impact pricing and other business strategies.

Q: What will be the impact on Swiggy’s operations after the IPO?

A: After an IPO, Swiggy will have more capital for expansion, innovation, and growth. However, being a public company also means increased scrutiny from shareholders and regulatory bodies, which could influence its business strategies and operations.